Last Update: September 2, 2018

When the oil industry learned how to get oil and natural gas from formations thought to be tapped out, a bleak dire scenario not unlike the Mad Max movies was avoided. The back-story of Mad Max was a society no longer able to get gasoline or diesel with which to power internal combustion engines. Ergo, society was breaking down, the rule of law was out the window, with violence and mayhem becoming the norm.

Twenty years ago George Mitchell developed hydraulic fracturing, aka fracking, on a hunch in West Texas. [NYTimes-Mitchell] Fracking uses a water and chemical mix, pumped at high pressure underground to fracture rock formations releasing the oil or natural gas. Typically the well is drilled straight down, then to drill at 90 degree angles, once the holes are ready a mix of water, chemicals and sand, is pumped underground.

The result is a dramatic increase in proven natural gas, and oil, reserves in the USA. They're now getting oil and natural gas in places thought to be barren of hydrocarbon reserves.

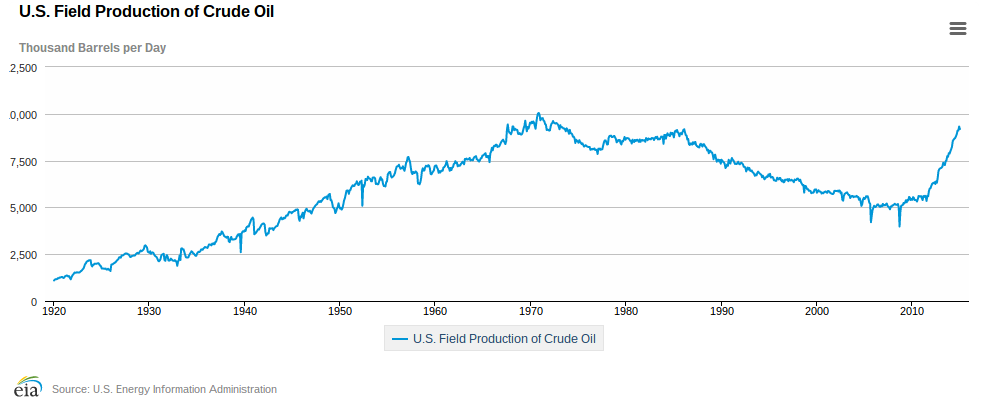

The chart above shows the effect on domestic oil production in the USA. The peak occurred in 1970-70 just like M. King Hubbert predicted back in the 1950's. There was a decline to a plateau that lasted until the late 1980's, then a smooth decline in domestic oil production until about 2008. Then, a sharp increase until production reached nearly the production level of 1970.

That date corresponds with wide-scale commercialization of fracking technologies. Mr. Mitchell developed the process 20 years ago, but it took awhile for the process to be distributed among the Oil Industry and widely used.

Now that there is experience with Fracking, the warning written by Richard Heinberg a few years ago looks very prescient. In

Snake Oil: How Fracking’s False Promise of Plenty Imperils Our Future, Heinberg wrote about the steep decline rates in oil production from wells which had been fracked as well as the high cost of fracking operations.

The phrase "decline rate" refers to how quickly production from a given well decreases, or declines, after the well is drilled. According to the studies Heinberg referenced, fracked wells began declining within a year or two, and the decline was very steep.

Another issue with fracking is the high cost. This is not oil production where you drill a hole and out comes a gush of crude oil. Instead, you drill a hole, line up a bunch of expensive equipment requiring a massive amount of diesel to operate the pumps that injects fracking fluids. The expense and the resource requirement adds up to a large cost, and it is difficult for a fracking-based oil company to make money.

According to an NY Times article, The Next Financial Crisis Lurks Underground, [NYTimes-crisis] there is grave potential for huge economic problems.

The 60 biggest exploration and production firms are not generating enough cash from their operations to cover their operating and capital expenses. [Economist1] In aggregate, from mid-2012 to mid-2017, they had negative free cash flow of $9 billion per quarter. Meaning that in total the industry lost money for 34 of the previous 40 quarters by March 2017 when the Economis report was written.

One issue arose in 2014 when the Saudi's tried to drive the Fracking companies out of business. The Saudis increased their production, causing lower prices, below where the Fracking companies could operate.

The NY Times lists several instances of questionable financial dealings to raise the capital to keep fracking operations alive. For example, between 2001-2012 Chesapeake Energy raised $16.4 billion of stock, $15.5 billion of debt, and another $30 billion through a variety of finagled deals. During that period the company never managed to report positive cash flow, much less a profit.

A key statement is:

A key reason for the terrible financial results is that fracked oil wells show a steep decline rate: The amount of oil they produce in the second year is drastically smaller than the amount produced in the first year. According to an economist at the Kansas City Federal Reserve, production in the average well in the Bakken — a key area for fracking shale in North Dakota [NYTimes-Downside] — declines 69 percent in its first year and more than 85 percent in its first three years. A conventional well might decline by 10 percent a year. For fracking operations to keep growing, they need huge investments each year to offset the decline from the previous years’ wells.

And this:

Because the industry has such a voracious need for capital, and capital costs money, fracking could not have taken off so dramatically were it not for record low interest rates after the 2008 financial crisis. In other words, the Federal Reserve is responsible for the fracking boom.

One consequence was the suspicious death of Aubrey McClendon, [McClendon Obituary] the former CEO of Chesapeake Energy. On March 2, 2016, McClendon died when his car collided with a concrete bridge. He was not wearing a seatbelt, and he made no attempt to avoid a collision. Somehow his death was ruled an accident. The day before the "accident" he had been indicted by a federal grand jury over violating antitrust laws.

Bottom line is that the companies aren't so much making money on profits from oil extraction. Instead they're making money from selling shares and other financial instruments.

In other words it's a financial bubble not based in any reality of producing real value.