Last Update: November 30, 2015

There’s another calamity looming in our future, even if the climate change problem doesn’t cause the predicted problems. The current system has resource constraints, the most important of which is called Peak Oil.

The bottom line is that over the long term oil prices, hence gasoline prices, are only going UP.

There will be short term price manipulations — for example, in early 2015 OPEC decided to maintain crude oil production at a level which caused global crude oil prices to collapse. It seems this was done to drive shale oil producers (especially in the U.S.) out of business, bursting the oil production bubble which promised to make the U.S. independent of OPEC’s oil. While this oil price collapse might look like evidence that gasoline prices aren’t going UP, the long term price for oil is UP as we’ll see here.

The facts about resource limitations say that eventually the oil companies will be incapable of finding ways to keep increasing the oil supply. At that point, simple economics says the high demand for crude oil and and its low supply will cause a rising price.

The concept was invented in the 1950’s by an oil company geologist, M. Hubbert King. His work was based on observing the rate of oil extraction from oil fields. A newly tapped oil field easily produces lots of crude oil, and that continues until a point where approximately have of the oil is extracted, after which time it becomes harder and harder to extract more oil.

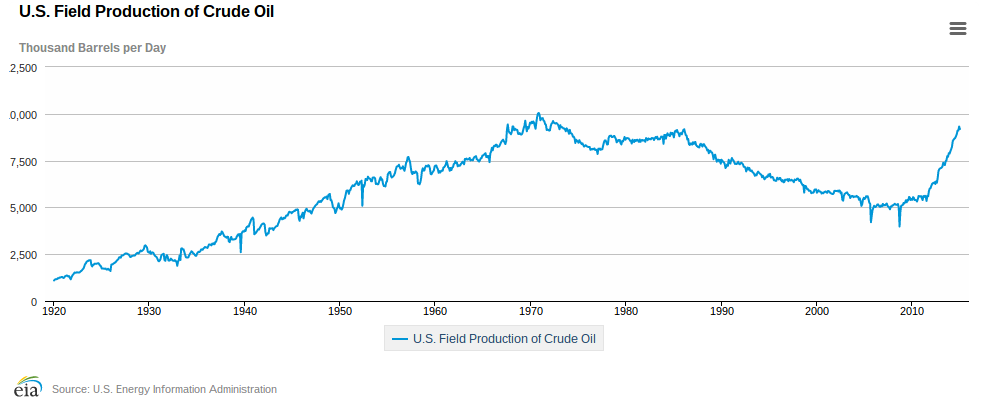

The result is like the chart above – the production rate increases until the field reaches its peak of oil production, after which the rate falls off. What Dr. King did is construct a theoretical model that would sum up the production rate of all oil fields around the planet. He predicted the peak of production for the whole U.S.A. would occur in 1970, and indeed that did happen. The peak oil model predicted a global peak of production in 2005-2006, which did occur.

However, hydraulic fracturing (fracking) of shale deposits in various U.S. locations, as well as strip mining Alberta tar sands, have made North America into a fossil oil power house. Production has risen nearly to the peak of US production in 1970. Doesn’t this disprove Dr. King’s theory? Nope. Read on.

The actual chart of US oil production is a little more complex than the previous chart. While it shows that in October 1970, as expected, the US peak of crude oil production occurred at 310 million barrels that month. But, what’s that oil production increase since 2010?

This is the effect of fracking shale deposits in North Dakota, Texas and elsewhere. Since this chart is U.S. oil production, it doesn’t include the effect of tar sands oil production in Alberta.

The fracking-induced oil production boom shown on this chart is a short term effect. A recent report by the Post Carbon Institute,

Drilling Deeper, took a careful look at Energy Information Administration projections of possible oil production from shale fields, and the actual results. The report showed that EIA projections were bunk. For example, the EPA has had to drastically reduce projected oil production in some fields such as the Monterey Shale which had been hoped to produce a huge oil bonanza in California. Richard Heinberg wrote a book,

Snake Oil: How Fracking’s False Promise of Plenty Imperils Our Future, starting from the Drilling Deeper report and discussing how every fracked shale field has quickly hit a production peak, and had a sharp decline in production. That means the fracking boom is nothing but a charade.

This chart, from Feb 2015, shows the previous 11+ years of gasoline prices. There’s a couple things to notice – the strong trend is toward rising prices, but instances where the price falls off rapidly. We some slight price declines such as September 2006, October 2012, and so on, and it might be interesting to go back and see why those occurred. The steep price decline beginning in August 2008 was because the economy nearly fell into a Great Depression, supposedly caused by a major financial crisis involving bogus home loans in the U.S. With the economy in a tailspin, gasoline demand fell off because lower economic activity meant fewer trucks driving stuff around. Bankrupt companies don’t have trucks driving around consuming fuel, after all. That caused fuel prices to fall, until the economy recovered, fuel demand rose, and prices went back up. Until the Winter of 2014-15, where (as said above)

OPEC decided to keep producing oil in an effort to collapse the global oil price and force shale oil producers out of business.

Another factoid to notice is the sheer volatility of gasoline prices.

Electricity is a different story. Electricity prices are set by public utilities commissions and are extremely stable. They might inch up every year by a little bit, but that’s tame compared to the wild swings in gasoline prices. Further, as the price for renewable energy resources like Wind and Solar fall, and they’re falling below parity with natural gas systems prices, the cost for electricity might fall.

As the gasoline price chart shows, U.S. gasoline prices in the mid-2000’s rose year-on-year until in early 2008 the national average gasoline price was at or near $4/gallon, and in California it was routinely above $5/gallon. A ninety mile trip, at $5/gallon, in a 30 MPG car, would cost $15 for fuel. Plenty of news stories documented how upset many were at this. The 2008 political scene was full of debate over high gasoline prices. Until, that is, the financial markets imploded causing us all to forget about gasoline prices and instead worry about a Great Depression (which, supposedly, we barely avoided).

What do those wild swings in gasoline prices mean for family finances. How can a family plan their budget if they cannot predict gasoline prices? Doesn’t an electric car eliminate that risk from the family budget?

It’s not just the family budget, but corporate budgets. Many company operations involve lots of fuel consumption to drive trucks around, or fly airplanes around. Most airlines are in financial trouble because of high fuel prices. The companies with truck fleets are starting to have the option of buying electric trucks, and not only slash fuel costs as outlined earlier, but insulate themselves from the economic risk of sudden sharp fuel cost increases.

In other words, this kind of price instability is not good for the economy.

Peak oil and long term gasoline or diesel prices

The long term price for gasoline and diesel is going up. The wild swings in gasoline prices shown earlier are due to price manipulations of the global oil market, but there is a fact underlying the fossil fuel market demonstrated by this chart. The global supply of easy-to-get oil is already declining, and will only continue declining.

The effect is called “peak oil”. The explanation around peak oil and its effect on gasoline prices is too long for this corner of this page. The short story is that we’re past the age of the easily extracted mega-oil-fields of the past. The remaining oil on the planet is all expensive to extract in both energy and money. Fracking, strip mining tar sands, etc, are all expensive resource intensive technologies. OPEC’s advantage, especially the Persian Gulf States, is that they’re sitting on the only sizeable pool of easy-to-extract oil and can undercut all others.

The bottom line is that the easy-to-get crude oil supplies will diminish, the fracked oil supplies will diminish, as will strip mined tar sands, and the price of gasoline will only go up.

Assuming electricity rates remain stable, electric vehicles will appear more and more attractive over time. The current price swing has to be seen as a short term blip in a long term trend. Did that precipitous fall in gasoline prices in 2008 make a long term difference? Nope. Nor will the precipitous gasoline price decline currently underway as I write this in January 2015.

But, wait, crude oil supplies are increasing, not decreasing, thanks to fracking

Okay, okay, yes, at the current time oil companies are fracking their way to an oil boom. We already covered this point earlier, and I suggest reading Richard Heinberg’s well-researched book. What he and his Post Carbon Institute colleagues point out is fracking will produce a short-lived oil boom, and that oil production will quickly fall off.

Fracking is an expensive process, as is extracting oil from the tar sands, as is drilling for oil in deep off-shore waters, as is drilling for oil in the arctic. In other words, the oil companies are having to go further afield, deploying very expensive techniques, to get crude oil from which they get the gasoline we buy.

That the oil companies have to utilize expensive techniques means that the easy-to-get inexpensively extracted crude oil is declining. That’s what the chart above shows, that the easy-to-get crude oil is beginning to run low.

The amount of oil they’ll extract from fracking won’t last for very long. Fracking is a horrendously toxic business, as is strip-mining tar sands to extract oil. Both are also very expensive.

Predicting the future

There’s no certainty about future oil supply and the ability of the oil companies to keep selling us liquid fuels that can be pumped at a gasoline station to power internal combustion vehicles. The estimates range from a gentle drop-off in oil supplies, in which we have a long time to adjust the technology mix, to a steep decline occuring faster than the automakers can switch us all to other drive train technology.

Some peak oil theorists predict doom and gloom as fuel supplies from crude oil dwindle. Society will be unable to function, there will be mass rioting and resource wars, etc, according to those predictions. The war over the Middle East and even in Ukraine can be seen as early salvo’s in the resource wars of the future.

In terms of predictions,

the Mad Max movies show an extreme example of what might happen – Peak Oil was the backstory of those movies.

Summary

What is our future worth to us? It’s not clear that if nothing changes, and “business as usual” continues as the model, that the fossil-fuel-dependent lifestyle we all live will continue for much longer. The marvelous globe-spanning culture we now live in is fueled by those fossil fuels. What will happen as fossil fuel supplies crash?

Will vast amounts of economic value vaporise as the industries will no longer function due to lack of fuel? What then?